Two "go woke or go broke" items in Disney's current shareholder proxy vote

Shareholders have seen their stock go on a roller coaster ride in recent years

I’ve been to Disney World over two dozen times in my life. It’s always been a place of good family memories both with as a kid with my parents and later as parent taking my kids to the parks.

In recent years, I’ve found my fondness for Disney World and Disney in general fading rather fast. Between high costs of a basic tickets and hotels coupled with the fleecing of additional dollars through apps like Genie+, Disney has exponentially pricing out the ability of of the average family to afford a vacation there.

But there’s another reason beyond the physical parks and their costs.

Like millions of other people, I hold stock in various companies. One of the stocks I hold is Disney, which I mostly inherited after my mom passed away in 2009.

At the time I gained that stock, it was a holding that was on the rise, going from a low of $15 a share in mid-2009 to a high of almost $202 in early March 2021.

Since that high, Disney's "woke" antics, political activism, and series of box office/Disney+ flops (its treatment of Star Wars immediately comes to mind) have put its stock price on a roller coaster ride, putting my nest egg, along with millions of other shareholders, in jeopardy.

Now it would seem Disney's board is realizing the company has a very real "go woke, go broke" problem.

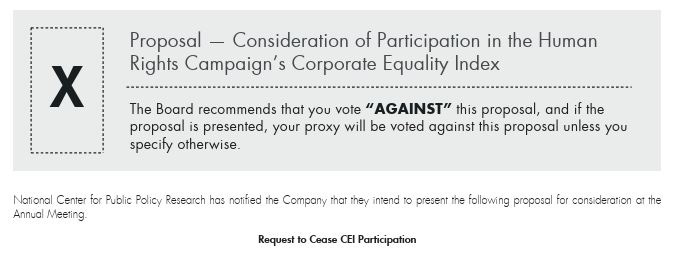

Disney regularly holds shareholder meetings and occasionally there are proxy votes solicited from stockholders on board positions and policy changes. I recently received my proxy vote request and found two items on the voting list of consequence: One on continuing using the left of center LGBT advocacy group's Human Rights Campaign's Corporate Equality Index, and another to evaluate Disney's previous involvement with the Global Alliance for Responsible Media (GARM) when it comes to advertiser buyer and seller selections.

HRC's Corporate Equality Index (CEI) has been used to pressure companies and industries to adopt policies like Diversity, Equity, and Inclusion, as well as LGBT, transgender, and gender ideologies in order to obtain an acceptable or higher rank on the CEI. Some have described the HRC as an "LGBTQ mafia."

GARM is an organization I've written about here on More To The Story. They use a similar method as HRC uses, by employing a "risk" assessment on companies, which turned out to really just be a means to censor certain political and social views. Last July, the U.S House Judiciary Committee held a hearing on GARM's influence over the ad market space and its "corporate collusion to silence conservative viewpoints." The following month, GARM allegedly disbanded after being hit with costly lawsuits.

The HRC proposal

Here's a rundown of what this shareholder proposal from the National Center for Public Policy Research says regarding Disney's participation in HRC's CEI.

The proposal requests that Disney reconsider its participation in the CEI, which is an annual assessment in which Disney has consistently received perfect scores since 2007 — An arguably dubious distinction.

The proponents frame the CEI as more than just a benchmarking tool, describing it as a "social credit score" that forces companies to take partisan positions. However, Disney's Board views their participation as part of their "broader commitment" to transparency and stakeholder engagement under appropriate Board oversight.

The proponents argue that Disney's participation in the CEI and related activism has harmed shareholder value.

They cite Disney's involvement in debates over the Parental Rights in Education Act and leaked comments about including LGBTQ+ content in programming as examples that led to a 44% stock price decline in 2022.

There are also references to similar controversies at other companies like Bud Light and Target that resulted in revenue losses and market cap declines. They also note that several major companies like Lowe's, Ford, Jack Daniels, and others have recently ended their CEI participation.

Here comes the self-implosion rub: Disney's current Board of Directors recommends that shareholders vote AGAINST this proposal.

The Board provides several reasons for their opposition. First, they argue that the company already provides transparency on important matters through various external surveys and initiatives.

Second, they note that the Board and its committees actively oversee workforce equity matters, ESG reporting, and human rights policies. ESG stands for Environmental, Social, and Governance, which are criteria a company uses to assess its operations in terms of its impact on society and the environment. This board apparently learned nothing from the collapse of the Silicon Valley Bank.

It's also worth noting here that NC's General Assembly passed a bill during the 2023-24 session prohibiting NC government entities from using or creating ESG criteria in investments. Former Governor Roy Cooper vetoed the bill but the legislature overrode it and the bill became law in July 2023. Former State Treasurer Dale Folwell was ahead of the curve on ESG back in 2022 and during that same year Congress held antitrust hearings involving ESG practices.

The Board's opposition emphasizes that their Global Public Policy team, along with Human Resources and Investor Relations, regularly assesses how to provide effective transparency. Finally, they conclude that given Disney's existing practices and oversight of ESG reporting, workforce "equity" matters, and human rights policies, the proposal would not provide additional value to shareholders.

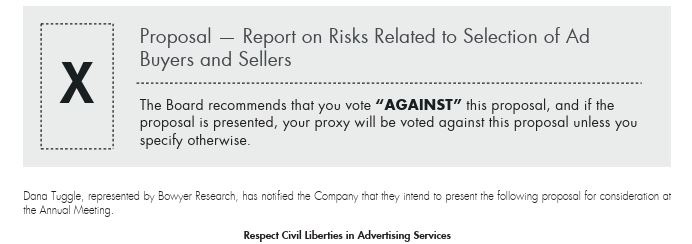

The Ads and GARM proposal

This shareholder proposal, submitted by Dana Tuggle and represented by Bowyer Research, requests that Disney's Board conduct an evaluation and issue a report on how it oversees risks related to discrimination against ad buyers and sellers based on their political or religious views.

The proposal centers on Disney's previous involvement with the Global Alliance for Responsible Media (GARM), a coalition that represented about 90% of global advertising spending. The proponents argue that GARM was used to demonetize various platforms, podcasts, and news outlets for expressing certain political and religious viewpoints under the guise of addressing "harmful and misleading media environments."

Specific examples were cited, such as GARM's actions against Spotify over Joe Rogan's COVID-19 views and their boycott of X (formerly Twitter) when Elon Musk reduced censorship restrictions.

Though GARM disbanded in 2024 following public pressure and a lawsuit from X, the proponents argue that these censorious practices continue through other channels, particularly through major advertising agencies.

As with the HRC proposal, the Disney Board of Directors recommends that shareholders vote AGAINST this proposal too.

The board provides three main reasons for their opposition to this measure.

First, they state that Disney already has existing policies governing responsible advertising and marketing practices, including adherence to antitrust and competition laws.

Second, they note that the Board and its committees, particularly the Audit Committee, already oversee compliance with laws, regulations, and company policies. The Board emphasizes that their Standards of Business Conduct includes resources for ethical conduct and compliance, with regular employee training and a confidential reporting hotline.

Finally, they argue that conducting the requested investigation and report would require significant resources and divert management's attention from running the business, while not providing meaningful additional information to shareholders beyond their existing disclosures.

In short, the proponents are framing this as a civil liberties issue, while the Board thinks it is being adequately addressed through existing oversight and compliance mechanisms.

As for the Shareholders? Well, we just want Disney to stop messing with our investments.